【印刷可能】 yield to maturity formula 175954-Yield to maturity formula

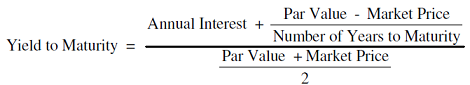

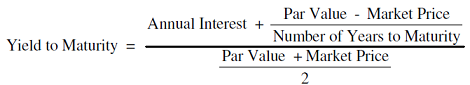

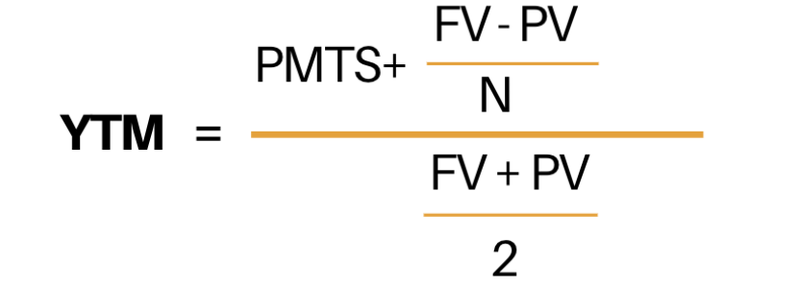

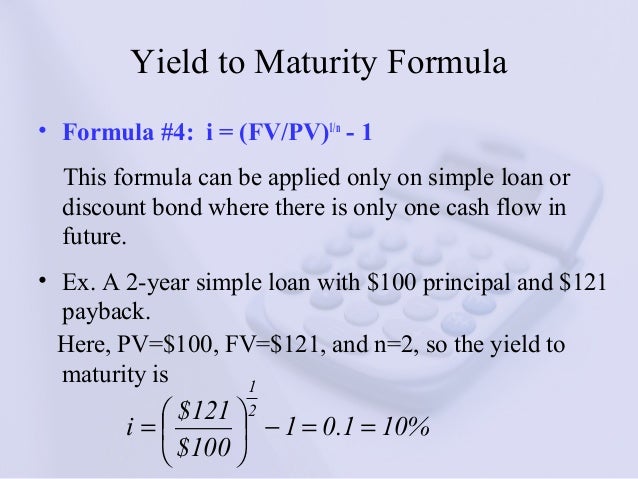

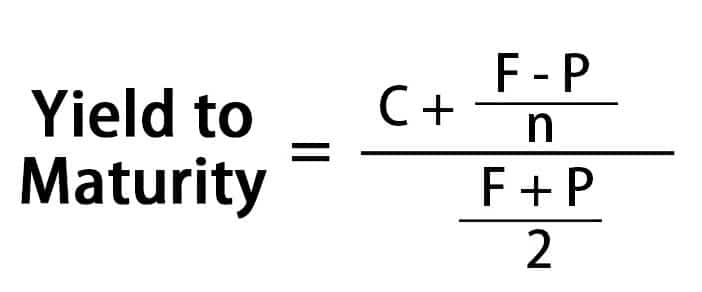

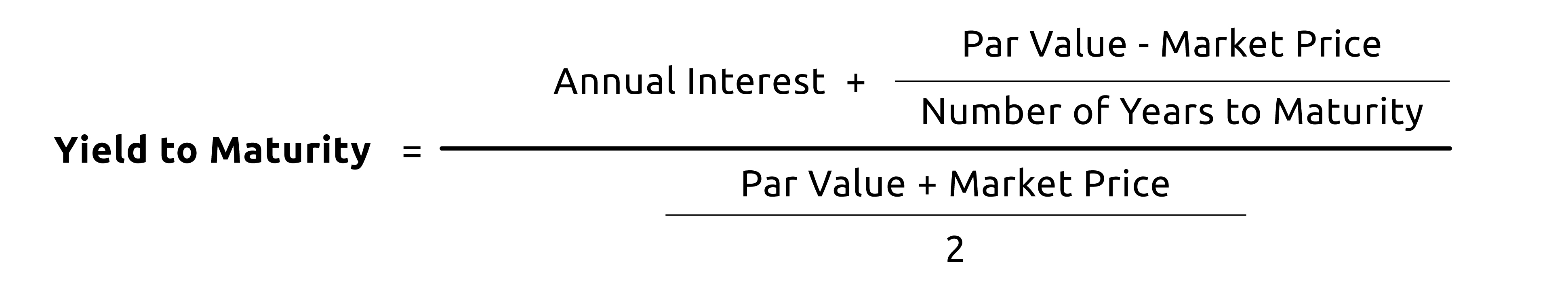

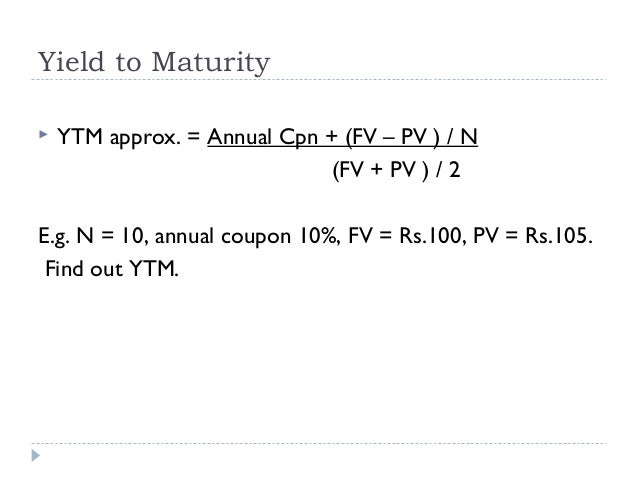

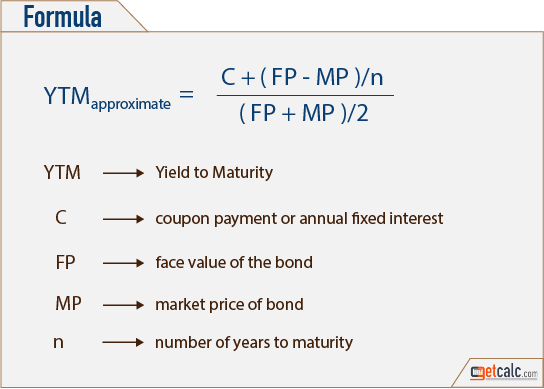

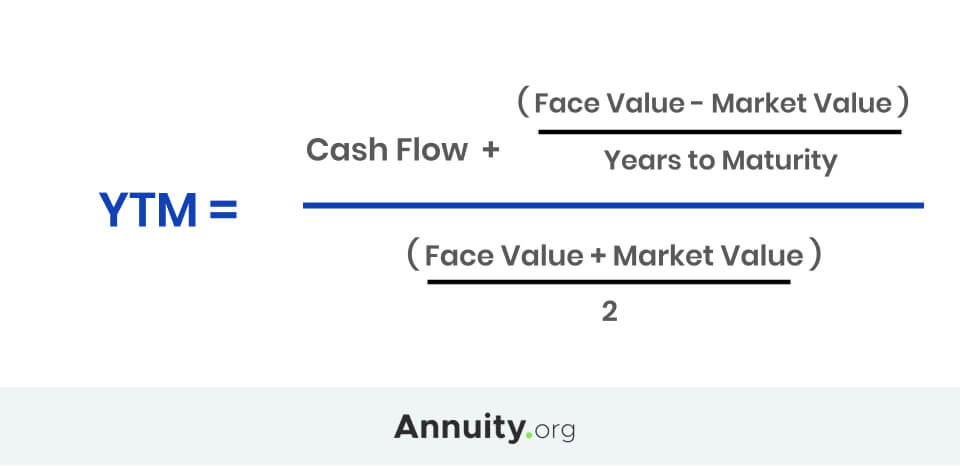

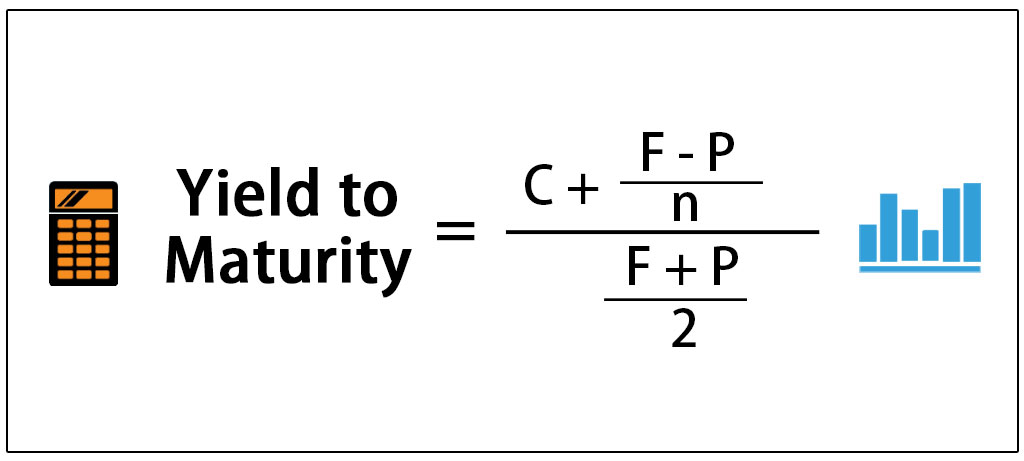

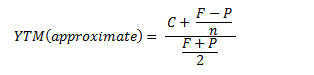

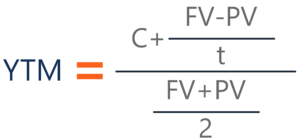

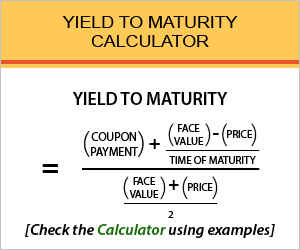

Yield to maturity formula Where, bond price = the current price of the bond Coupon = Multiple interests received during the investment horizon These are reinvested back at a constant rate Face value = The price of the bond set by the issuerYield to Maturity (YTM) Yield to Maturity (YTM) is the expected return an investor would earn if he/she holds the bond until its maturity For example, if a bond's face value is Rs 1000, maturity is 5 years, and coupon is 8%, it implies that if you were to hold the bond for 5 years, then you shall get Rs 80 per year as interest till the 5th year, after which you shall get your principalYield to Maturity Formula refers to the formula that is used in order to calculate total return which is anticipated on the bond in case the same is held till its maturity and as per the formula Yield to Maturity is calculated by subtracting the present value of security from face value of security, divide them by number of years for maturity and add them with coupon payment and after that dividing the resultant with sum of present value of security and face value of security divided by 2

What Is Yield And How Does It Differ From Coupon Rate

Yield to maturity formula

Yield to maturity formula-Whereas, the current yield is the annual coupon income divided by the current price of the bondYield to Maturity (YTM) is the most commonly used and comprehensive measure of risk In fact, if someone talks about just 'Yield' they are most likely referring to Yield to Maturity In simple terms, YTM is the discount rate that makes the present value of the future bond payments (coupons and par) equal to the market price of the bond plus

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

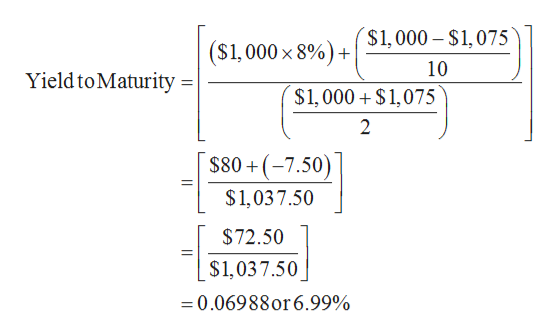

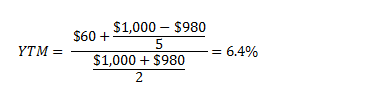

Whereas, the current yield is the annual coupon income divided by the current price of the bondYield to maturity is similar to current yield, which divides annual cash inflows from a bond by the market price of that bond to determine how much money one would make by buying a bond and holdingTo apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables

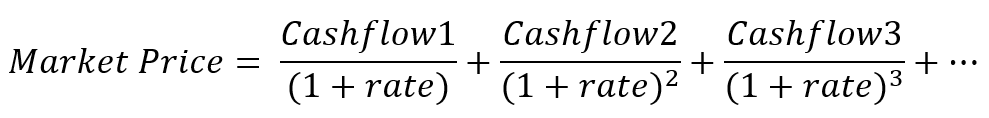

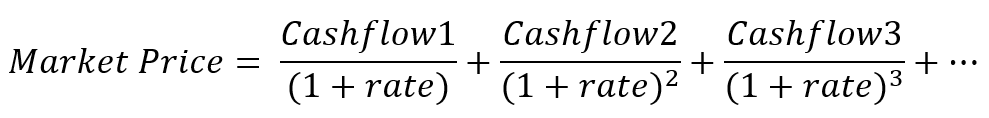

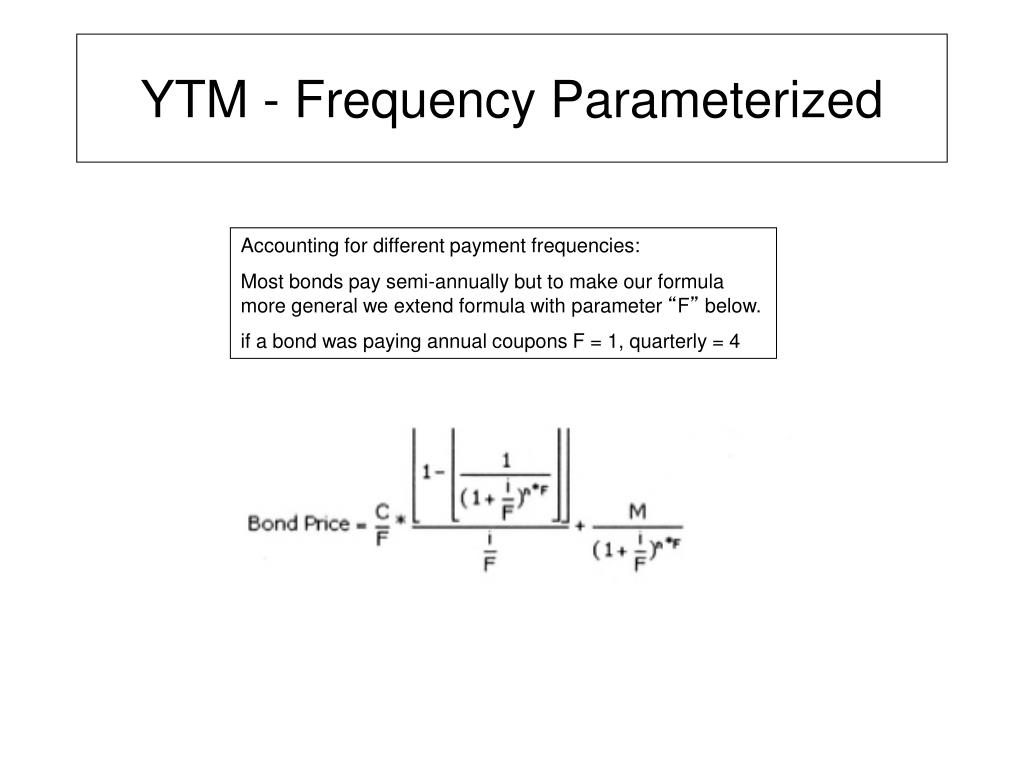

The calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturityIt doesn't allow us to isolate a variable and solve Estimated Yield to Maturity FormulaYield to Maturity Sarah received a $100 bond as a graduation gift The longterm bond was set to mature 15 years from the date it was issued There's still five more years remaining until it matures

The formula for calculating yield to maturity is a bit complex for a beginning investor But even professional bond buyers don't usually take pen to paper to calculate a bond's yield to maturity That figure will be automatically computed for you by any reputable bond broker at the time you're ready to buyThe formula's purpose is to determine the yield of a bond (or other fixedasset security) according to its most recent market price The YTM calculation is structured to show – based on compounding – the effective yield a security should have once it reaches maturityFor callable bonds, knowing the coupon rate and yield to maturity only tells you part of the story To make informed investment decisions, you need to know what the bond's yield would be if it

Yield To Maturity Ytm Definition Formula And Example

1

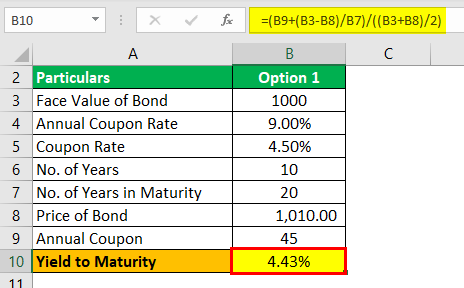

The yield to maturity (YTM) measures the interest rate, as implied by the bond, that takes into account the present value of all the future coupon payments and the principalIt is assumed that bond holders can invest received coupons at the YTM rate until the maturity of the bond;Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown below Note that the actual YTM in this example is 987% However, our approximation is good enough for exams or for quick comparisonsYield to Maturity (YTM) Excel Template Use this Excel template to calculate the Yield to Maturity (YTM) in Excel Download the template from the following link Download Template Input required values in the 'User Inputs' section and you will get the YTM automatically (lower part of the template) So easy to use and straightforward

Bond Yield Calculator

What Is Yield And How Does It Differ From Coupon Rate

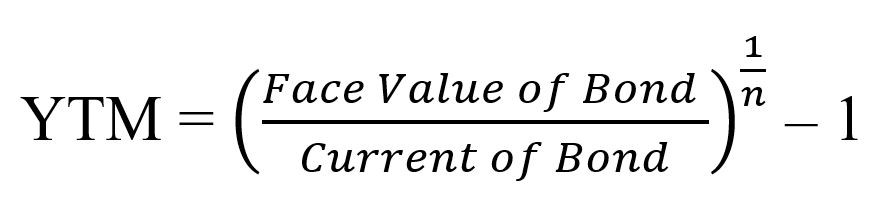

To calculate yield to maturity of a bond, the present value of the bond needs to be known In this way, yield to maturity (r) can be calculated in reverse with the help of the present value of the bond formula Example of Yield to Maturity ABC Inc issues a bond with a face value of $1500, and the discounted price is $10 The annual couponIt doesn't allow us to isolate a variable and solve Estimated Yield to Maturity FormulaThe yield to maturity formula, also known as book yield or redemption yield, is used in finance to calculate the yield of a bond at the current market price It is calculated to compare the attractiveness of investing in a bond with other investment opportunities

Duration Vs Maturity And Why The Difference Matters

Bond Yield Calculator

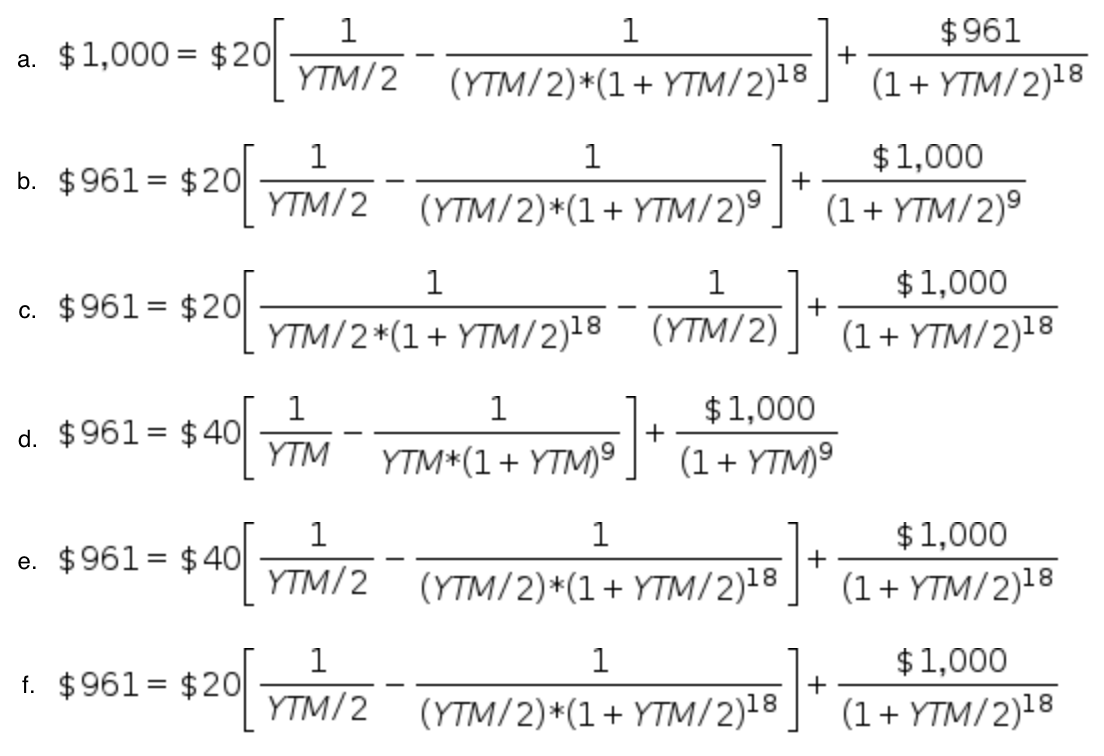

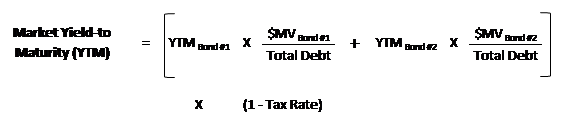

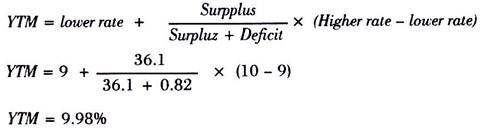

Yield to Maturity Formula Example #2 Consider a market bond issued in the market having a bond period of 5 years and an interest coupon rate of 9% Consider the issue price of Bond at $ 90, and redemption value be $ 105 Calculate the posttax Yield to Maturity for the investor where the rate of normal Income tax can be assumed at 30% andThe following formula can be used to calculate it Where C – Interest/coupon payment FV – Face value of the security PV – Present value/price of the security t – How many years it takes the security to reach maturity The overall expected return for an investor if the bond is held to maturity is known as yield to maturity (YTM)How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900 The bond pays interest twice a year and matures in 5 years Enter "1,000" as the face value, "8" as the annual coupon rate, "5" as the years to maturity, "2" as the coupon payments per year, and "900" as the current bond price

Solved 9 Year 4 Semi Annual Coupon Bond With 1 000 Fa Chegg Com

Yield To Maturity Formula Step By Step Calculation With Examples

This yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturityBond Yield to Maturity Formula For this particular problem, interestingly, we start with an estimate before building the actual answer That's right the actual formula for internal rate of return requires us to converge onto a solution;Using the YTM formula, the required yield to maturity can be determined 950 = 40/ (1YTM)^1 40/ (1YTM)^2 40/ (1YTM)^3 1000/ (1YTM)^3 We can try out the interest rate of 5% and 6% The bond prices for these interest rates are INR and INR , respectively

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Quant Bonds Yield

To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variablesYield to maturity formula is for calculating the bond based yield on its current market price rather than the straightforward yield which is discovered utilizing the profit yield equation To calculate yield to maturity, the bond price or bond's current value must already be knownThe calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

Bonds Yield To Maturity Example 1 Youtube

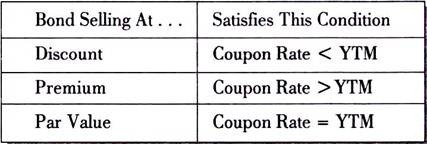

The Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or losses The YTM is the internal rate of return of the bond, so it measures the expected compound average annual rate of return if the bond is purchased at the current market price and is held to maturityYield to Maturity (YTM) is the most commonly used and comprehensive measure of risk In fact, if someone talks about just 'Yield' they are most likely referring to Yield to Maturity In simple terms, YTM is the discount rate that makes the present value of the future bond payments (coupons and par) equal to the market price of the bond plusThe yield to maturity formula, also known as book yield or redemption yield, is used in finance to calculate the yield of a bond at the current market price It is calculated to compare the attractiveness of investing in a bond with other investment opportunities

Valuing Bonds Boundless Finance

What Is Yield To Maturity How To Calculate It Scripbox

Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown below Note that the actual YTM in this example is 987% However, our approximation is good enough for exams or for quick comparisonsThe Yield to Maturity Unlike the current yield, the yield to maturity (YTM) measures both current income and expected capital gains or losses The YTM is the internal rate of return of the bond, so it measures the expected compound average annual rate of return if the bond is purchased at the current market price and is held to maturityFormula to calculate yield to maturity C – Interest/coupon payment FV – Face Value of the bond PV – Present value of the bond t – Number of years it takes the bond to reach maturity Example Assume that there is a bond on the market priced at $800 and that the bond comes with a face value of $900 The yearly coupons on this bond

Berk Chapter 8 Valuing Bonds

What Is Yield To Maturity Ytm Millionacres

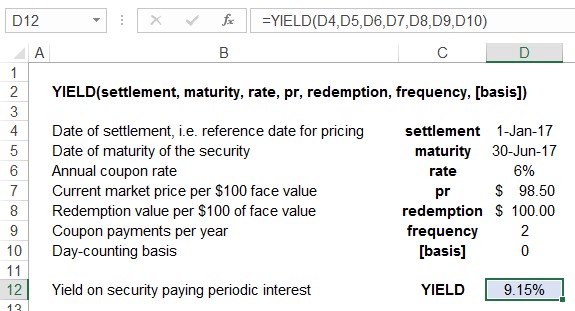

YIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year In the context of debt securities, yield is the return that a debtholder earns by investing in a security at its current priceFree Online Textbook @ https//businessfinanceessentialspressbookscom/An example of calculating YieldtoMaturity using the 5key approachThe formula for Bond Yield can be calculated by using the following steps Step 1 Firstly, determine the bond's par value be received at maturity and then determine coupon payments to be received periodically

Bonds Yield To Worst Current Yield Vs Yield To Maturity

Perpetuity Yield To Maturity Youtube

Yield to Maturity (YTM) is the most commonly used and comprehensive measure of risk In fact, if someone talks about just 'Yield' they are most likely referring to Yield to Maturity In simple terms, YTM is the discount rate that makes the present value of the future bond payments (coupons and par) equal to the market price of the bond plusYield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input valuesTo apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables

Weighted Average Cost Of Capital Guide Wacc Calculator Excel Download

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

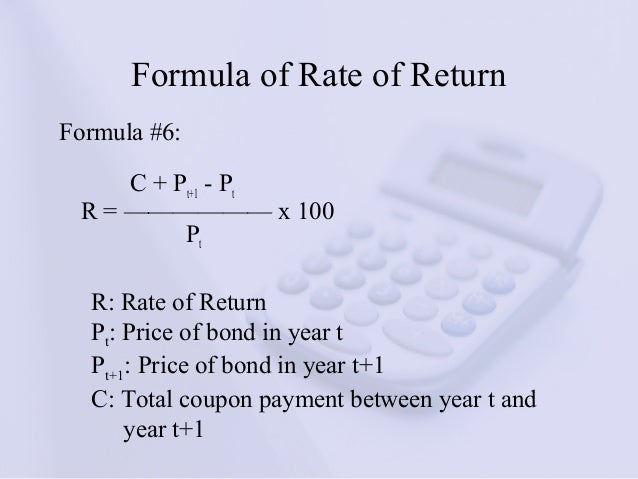

The current yield is 0619 or 619%, here's how to calculate ($5750 coupon / $922 current price) The yield to maturity is the yield earned on a bond based on the cash flows promised from the date of purchase until the date of maturity;Bond Yield to Maturity Formula For this particular problem, interestingly, we start with an estimate before building the actual answer That's right the actual formula for internal rate of return requires us to converge onto a solution;The formula for calculating yield to maturity is a bit complex for a beginning investor But even professional bond buyers don't usually take pen to paper to calculate a bond's yield to maturity That figure will be automatically computed for you by any reputable bond broker at the time you're ready to buy

Finding Yield To Maturity Using Excel Youtube

Calculate The Ytm Of A Coupon Bond Youtube

Yield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price Yield to maturity is essentially the internal rate of return of a bond ie the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market priceDefinition The yield to maturity (YTM) of a bond is the internal rate of return (IRR) if the bond is held until the maturity date In other words, YTM can be defined as the discount rate at which the present value of all coupon payments and face value is equal to the current market price of a bondYield to Maturity Sarah received a $100 bond as a graduation gift The longterm bond was set to mature 15 years from the date it was issued There's still five more years remaining until it matures

Learning Unit 09 Interest Rate

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Formula to calculate yield to maturity C – Interest/coupon payment FV – Face Value of the bond PV – Present value of the bond t – Number of years it takes the bond to reach maturity Example Assume that there is a bond on the market priced at $800 and that the bond comes with a face value of $900 The yearly coupons on this bondThe yield to maturity formula is used to calculate the yield on a bond based on its current price on the market The yield to maturity formula looks at the effective yield of a bond based on compounding as opposed to the simple yield which is found using the dividend yield formulaThe yield to maturity (YTM), book yield or redemption yield of a bond or other fixedinterest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on schedule

Bond Yield Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900 The bond pays interest twice a year and matures in 5 years Enter "1,000" as the face value, "8" as the annual coupon rate, "5" as the years to maturity, "2" as the coupon payments per year, and "900" as the current bond priceAccording to riskneutral expectations, the payments received should be the same as the price paid for the bondFormula to calculate yield to maturity C – Interest/coupon payment FV – Face Value of the bond PV – Present value of the bond t – Number of years it takes the bond to reach maturity Example Assume that there is a bond on the market priced at $800 and that the bond comes with a face value of $900 The yearly coupons on this bond

Yield To Worst What It Is And Why It S Important

What Is The Approximated Yield To Maturity Ytm Forex Education

The current yield is 0619 or 619%, here's how to calculate ($5750 coupon / $922 current price) The yield to maturity is the yield earned on a bond based on the cash flows promised from the date of purchase until the date of maturity;For callable bonds, knowing the coupon rate and yield to maturity only tells you part of the story To make informed investment decisions, you need to know what the bond's yield would be if itPlug the yield to maturity back into the formula to solve for P, the price Chances are, you will not arrive at the same value This is because this yield to maturity calculation is an estimate Decide whether you are satisfied with the estimate or if you need more precise information

Yield To Maturity For Bond Valuation For Ca Final Sfm Video Classes Online Satellite Offline Youtube

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

The calculator uses the following formula to calculate the yield to maturity P = C×(1 r)1 C×(1 r)2 C×(1 r)Y B×(1 r)Y Where P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity

What Is A Zero Coupon Bond

What Is Yield To Maturity How To Calculate It Scripbox

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

Cost Of Debt Definition Formula Calculation Example

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Best Excel Tutorial How To Calculate Ytm

Yield To Maturity Ytm Definition Formula Calculations In Debt Mutual Fund Nippon India Mutual Fund

Bond Valuation

What Is Realized Yield Fincash

The Yield To Maturity And Bond Equivalent Yield Fidelity

Bonds Part Iii Pricing Financial Modeling History

Q Tbn And9gcs8pllmjk Cwco2cxddqmohomgedhyw Veiacyoq Lypi38bu2o Usqp Cau

Bond Equivalent Yield Formula Calculator Excel Template

Realized Compound Yield Versus Yield To Maturity Rate Return

Ytm Yield To Maturity Calculator

Bond Basics Bond Yields Flashcards Quizlet

Yield To Maturity Components And Examples Of Yield To Maturity

Yield Curve How Yield Curve Changes Affect Annuities

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

Bond Pricing Formula How To Calculate Bond Price

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Yield To Maturity Ytm Overview Formula And Importance

Zero Coupon Bond Yield Formula With Calculator

How To Calculate Yield For A Callable Bond The Motley Fool

1

Answered How Do You Calculate Yield To Maturity Bartleby

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Bond Basics Bond Yields Flashcards Quizlet

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

Yield To Maturity Fixed Income

Low Price Equals High Yield And Vice Versa

Yield To Maturity Ytm Formula Interest And Deposit Calculators

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Yield To Maturity Definition How To Calculate Ytm Pros Cons

Bond Valuation Wikipedia

How To Calculate Bond Price And Yield To Maturity Pdf Free Download

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Yield To Maturity Formula Step By Step Calculation With Examples

Yields To Maturity On Zero Coupon Ronds Bond Math

The Formula For Calculating The Present Value Of A Consol Bond Is The Same Course Hero

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Ytm Formula Excel

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

Write Down The Formula That Is Used To Calculate The Yield To Maturity On A Year 10 Coupon Bond Brainly Com

Yield To Maturity

Yield To Maturity Calculation In Excel Example

Q Tbn And9gct1q6zxynbcvmgspi Wpg Zzjvgvz 1ltnjyviqmbaypurzxz Usqp Cau

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Yield To Maturity Ytm Calculator

Current Yield Meaning Importance Formula And More

Yield To Maturity Ytm Overview Formula And Importance

Yield To Maturity Ytm And Yield To Call Ytc alectures Com

How To Use The Excel Yield Function Exceljet

Learn To Calculate Yield To Maturity In Ms Excel

Yield Function Formula Examples Calculate Yield In Excel

Vba To Calculate Yield To Maturity Of A Bond

Yield To Maturity Approximate Formula With Calculator

A What Is The Maturity Of The Bond In Years Maturity Of The Bond 2 10 Years Course Hero

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Yield To Maturity Calculator Find Formula Check Example More

Yield To Maturity Formula Ppt Download

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

How Do I Calculate Yield To Maturity Ytm With A Simple Handheld Calculator For Semiannual Payments Personal Finance Money Stack Exchange

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Bond Valuation By Binam Ghimire Ppt Video Online Download

Solved I Am Applying The Yield To Maturity Formula As Is Chegg Com

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Maturity Formula Step By Step Calculation With Examples

10 Bond Prices And Yields Mcgraw Hill Irwin Ppt Video Online Download

Easy Method To Calculate Ytm Yield To Maturity For Jaiib Caiib 16

コメント

コメントを投稿